Warren Buffett to Step Down as CEO of Berkshire Hathaway at Year’s End

Warren Buffett confirmed Saturday he will step down as CEO of Berkshire Hathaway at year’s end, marketing the end of an era for the legendary investor who symbolizes the explosive growth and influence of equities markets since the 1970s.

Buffett broke the news Saturday at the close of Berkshire Hathaway’s hours-long annual shareholders meeting in Omaha, Neb. He told the group that he hopes the Berkshire board of directors will select Abel, a 25-year Berkshire veteran, to succeed him.

“The time has arrived where Greg should be the chief executive officer of the company at year end,” Buffett said. He received a rapturous standing ovation.

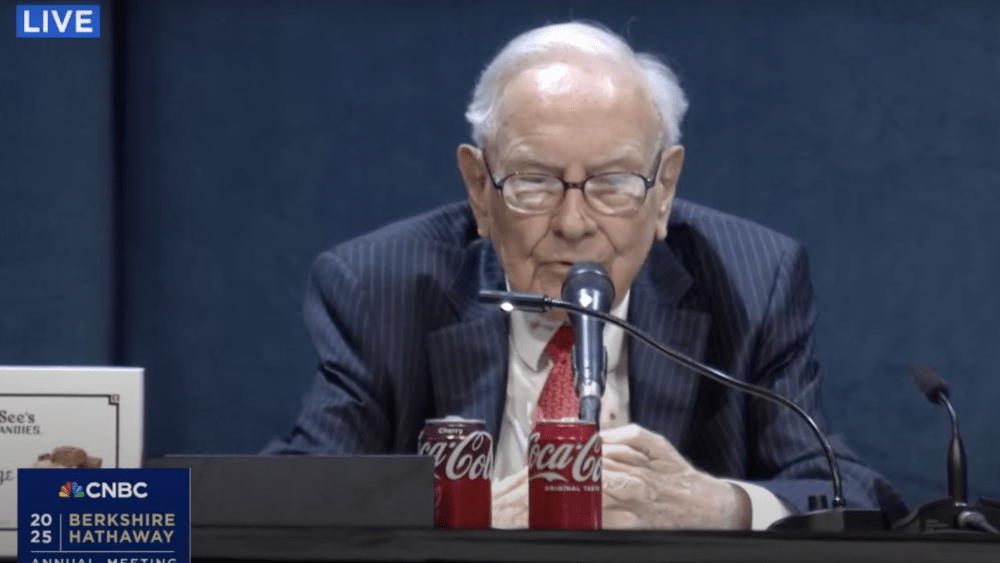

“Drink your Coke and calm down,” Buffett finally said after a few minutes to quiet the crowd. He vowed to not sell “a single share” in the holding company he has built for 60-plus years.

Abel has been tabbed for several years as the heir apparent to Berkshire’s 94-year-old leader. But Buffett’s timetable for the transition had been unclear until Saturday. Buffett noted that the news of his year-end target was coming as a surprise in the moment to Abel, who sat with Buffett on a dias at the CHI Health Center complex in Omaha as the two fielded questions from shareholders.

CNBC live streamed the event, known as “Woodstock for capitalists,” which also includes celebratory activities around the Omaha area and around Berkshire brands such as See’s Candies and Coca-Cola.

Buffett noted that only two of Berkshire’s 11 board members — his children Howie and Susie — were aware that he intended to break the news at the meeting. Buffett told the crowd that the board will meet on Sunday to discuss the transition. He predicted they would take action at the following board meeting in a few months. Buffett made it clear he sees no roadblocks to Abel taking the job.

“I think they’ll be unanimously in favor of it, and that would mean that at year-end Greg would be the chief executive officer of Berkshire. I would still hang around and conceiveably useful in a few cases but he final word would be what Greg said,” he said.

Abel is CEO of Berkshire Hathaway Energy, running a huge division of the company. He joined the company through an acqusition in 2000. Abel did not address the crowd after Buffett’s announcement but he did stand up and applaud the Oracle of Omaha as other Berkshire executives joined them on stage.

Buffett had a clever quip to end the meeting: “The enthusiasm shown by that respponse could be interpreted in two ways, but I’ll take it.”

CNBC’s Becky Quick, who helps moderate parts of the shareholders meeting, later reported that the plan is for Howie Buffett to become non-executive chairman of Berkshire Hathaway. She also noted that the company’s headquarters will remain in Omaha despite Abel being based out of Des Moines, Iowa.

Berkshire Hathaway has a diverse portfolio of energy, transportation and real estate holdings. On Buffett’s watch since 1965, the company has sporadically invested in media. Berkshire had a significant position in Disney in the 1990s and 2000s.

Buffett has unparalleled stature as a respected figure in business — who operates at arm’s length from traditional Wall Street investment giants – and one who has long preached the importance of slow and steady investing in company’s bolstered by overall strong fundamentals and products. The growth of Berkshire Hathaway into one of the world’s most valuable companies has been a beacon for how a portfolio of savvy investments and a commitment to solid operating principles can drive long-term wealth. From the 1980s on, Buffett’s enormous wealth and folksy charm made him one of the most recognizable business figures in the world.